Are Marketplaces Defensible In The Age Of AI Purchasing Agents?

Introduction

Throughout history, marketplaces have evolved with technology to reshape the way we acquire goods. The invention of currency, for example, addressed the inefficiencies of the barter system. Department stores standardized pricing and enhanced transparency. Global supply chains enabled the availability of goods at scale. The internet erased geographic barriers, and mobile technology made instant delivery an expectation. In each era, marketplaces responded to advances in technology by innovating, relentlessly optimizing price, inventory, and delivery to reduce friction and better serve the needs of the consumer.

Now, another shift is underway. AI purchasing agents are transforming how consumers interact with marketplaces. AI agents are likely to abstract users away from browsing and selecting, at the risk of commoditizing marketplaces. As a result, marketplaces must evolve to remain relevant and defend their economic moats. Unless they find ways to differentiate in an agent-mediated world, marketplaces could become the equivalent of background utilities.

This article is the second in a two-part series examining the evolution of marketplaces. In the first, we journeyed through the marketplace innovations that lowered friction in the purchasing process. In this piece, we examine the rise of agentic commerce in the age of AI, the existential threat it poses to marketplaces, and the role that AI agents could play in helping them compete by optimizing prices, inventory, and delivery—the fundamental drivers of consumer choice.

The Rise Of AI-Mediated Consumption

Imagine a shopping experience in which autonomous AI purchasing agents act on behalf of shoppers, continuously sweeping marketplace listings, brand sites, social-commerce feeds, and loyalty inventories. In real-time, agents scan catalog data and user-generated content, compare specs across sellers, and negotiate prices. By the time they surface purchase options, the discovery, comparison, and evaluation are already complete.

.png)

Source: ARK Investment Management LLC, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Today, more than 90% of the consumer journey takes place before a single click online. From a business perspective, the opportunity is in compressing the top of the funnel, not expanding it. AI agents take mere seconds to find and match stock keeping units (SKUs), summarize reviews by theme and sentiment, simulate thousands of price-promotion scenarios, and filter results through a dynamic preference graph that reflects a consumer’s budget elasticity, brand affinities, and past return behavior. What once required spreadsheets and several open tabs collapses into a conversational prompt that, in seconds, generates a curated shortlist.

| Funnel Stage | Traditional Marketplaces | AI Agents |

| Discovery | Keyword search, ad clutter, endless scrolling | Constant scan of structured (catalog data) and unstructured (video, UGC) signals to surface in-spec items |

| Engagement/Evaluation | Manual price checks, reading reviews, spec-sheet detective work | Comparison of attributes across sellers, eliminating counterfeit listings and clustering reviews by theme and sentiment |

| Decision Making | Coupon hunting, loyalty math, fear of missing a better deal | Simulation of price–promotion combinations through the lens of personal constraints and preferences, like budget, sustainability, and warranty |

| Purchasing | Form completion, checkout redirects, shipping guesswork | Completion of the transaction, applying payment preferences and post-purchase tracking |

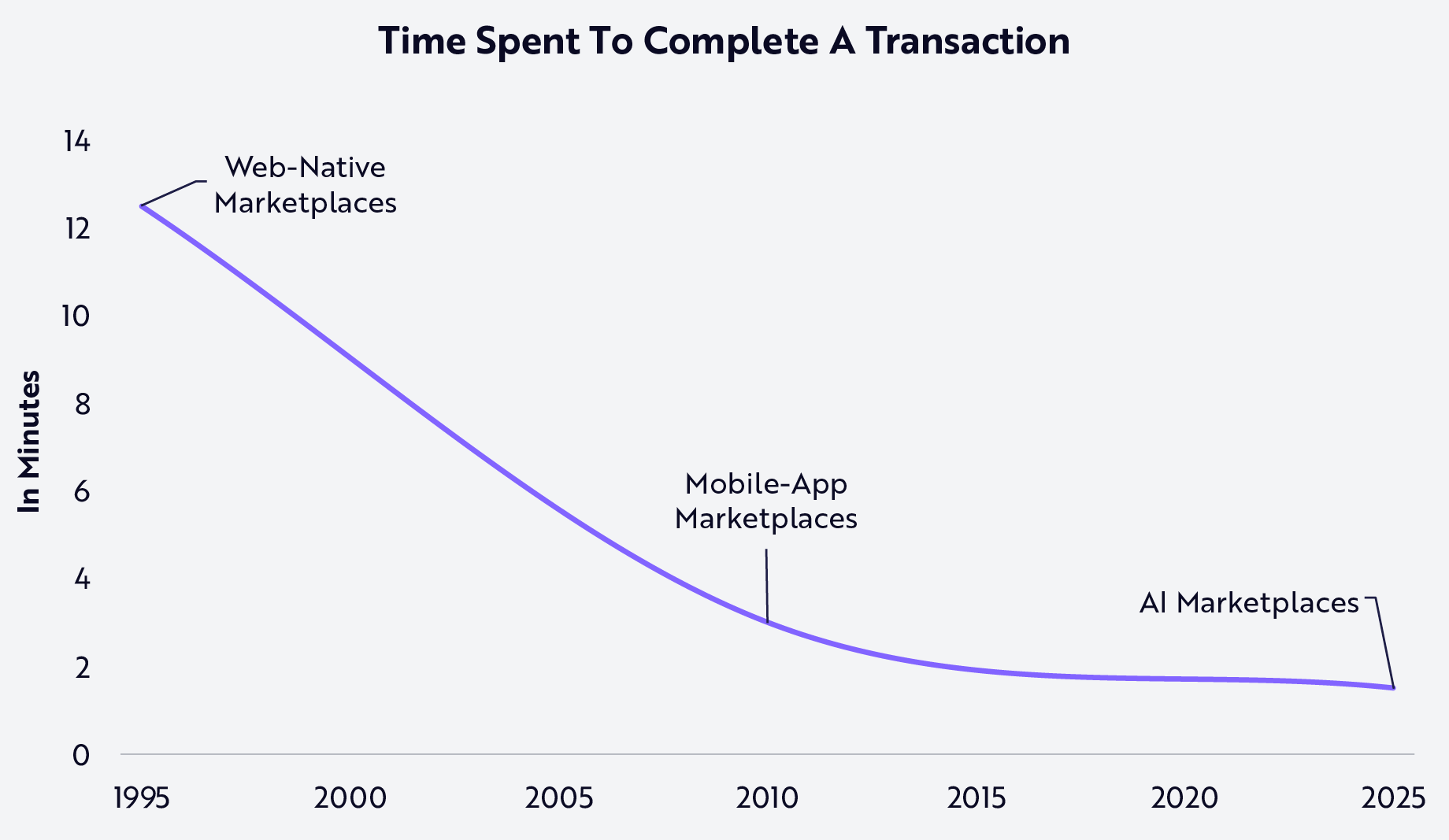

AI agents are collapsing the gap between need/desire and delivery. The time required to complete a transaction has fallen sharply—from several minutes in the early days of web-native marketplaces to near-zero in the AI-native era, as shown in the chart below. The time compression is not a function of just speed, but a fundamental shift in decision-making leading to transactions.

Source: ARK Investment Management LLC, 2025, based on data from Ashby 2019 and From the Aldergrove 2024. Data as of April 20, 2025.1 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

When AI agents can handle product discovery, evaluation, and execution in real time, marketplaces will be forced to compete on precision, performance, and trust. No longer will personalization serve just high-end commerce: it will become essential to all commerce. In the most successful marketplaces, AI agents will deliver accurate, timely and cost-effective results. As agents move from experimentation to deployment, personalization will lock users into ecosystems that operate with near-frictionless efficiency.

The Infrastructure Behind Agentic Commerce

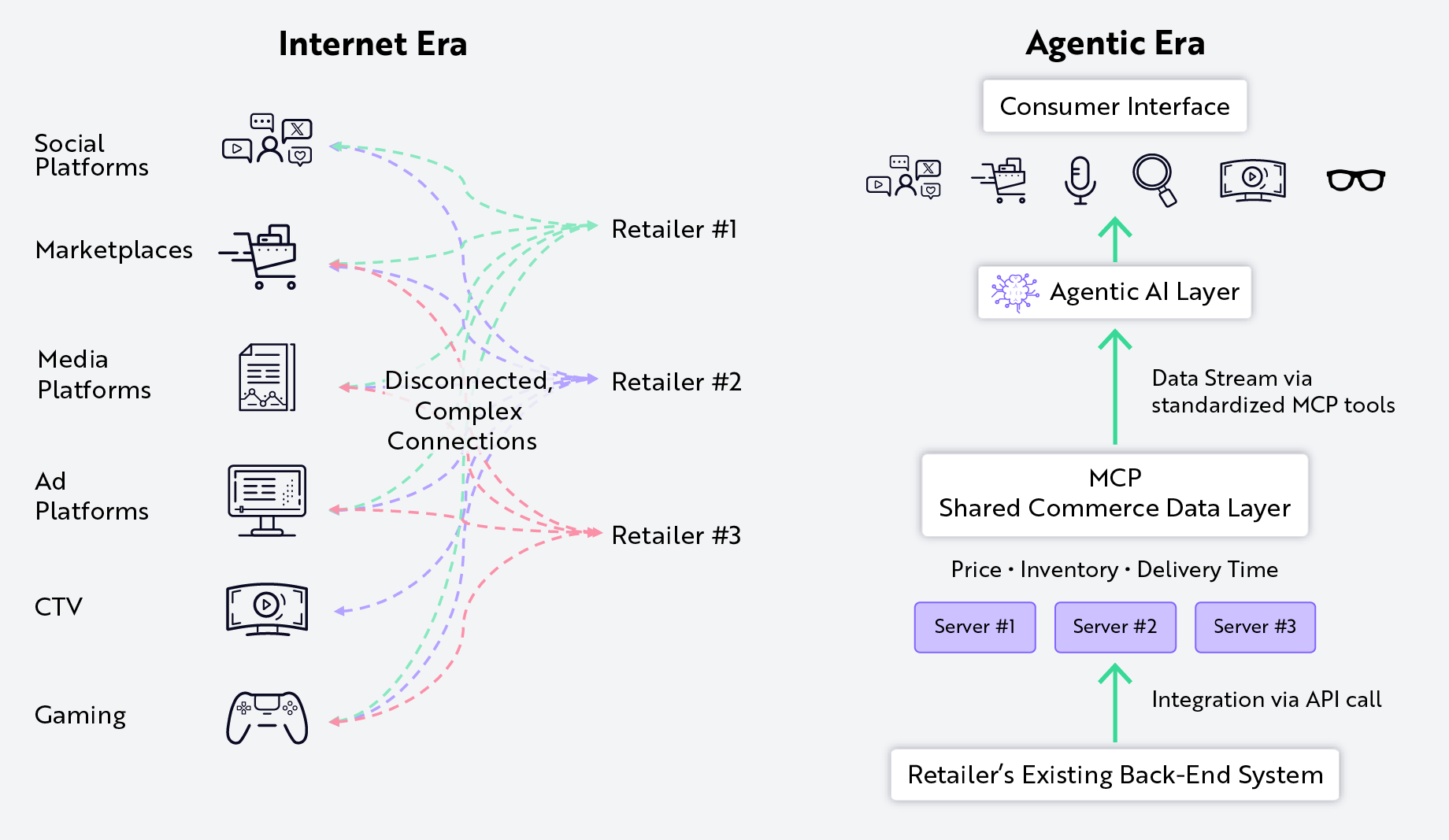

How do AI agents do what they do? To understand, we look back at the early days of the web, when Hypertext Transfer Protocol Secure (https) unlocked the internet’s commercial potential with secure communication between browsers and servers. Similarly, Model Context Protocol (MCP) is becoming foundational to the age of intelligent agents. Just as https standardized safe interactions between browsers and websites, MCP is standardizing interactions among AI agents, application programming interfaces (APIs), databases, and user interfaces. As a result, MCP is becoming a trusted translation layer that gives agents the context and access they need to navigate, interpret, and act across the complex landscape of tools and services that power today’s tech ecosystem.

The implications for commerce are significant. Typically today, retailers integrate individually with each consumer-facing platform, such as social media, marketplaces, ad networks, connected TVs, and gaming environments. These connections are bespoke, brittle, and expensive to maintain, resulting in a tangled web of redundant APIs, inconsistent data pipelines, and platform-specific constraints. As a result, retailers must deal with major operational inefficiencies while consumers experience delays, outdated inventories, and/or incomplete product visibility. Capitalizing on that friction, retail operating platforms like Shopify offer centralized integration workflows that help merchants streamline connections across sales channels and reduce complexity at scale.

In the Age of AI, we believe MCP will go even further by simplifying and creating an intelligent commerce stack. Instead of point-to-point integrations, retailers should be able to connect their back-end systems to MCP servers, which act as unified clearinghouses for core commercial data like price, availability, and delivery windows. This shared layer feeds real-time data into large language models (LLMs), which then interface with consumer-facing applications like voice assistants, search agents, smart TVs, and smart glasses.

With this architecture, agents do not need to build bespoke connectors between retailers and channels. Instead, they leverage standardized MCP tools to query real-time data across the entire retail ecosystem, as shown below. Notably, Shopify now supports MCP endpoints natively, enabling its merchants to feed product and inventory data directly into the agentic web. While reducing integration complexity, Shopify with MCP also is unlocking entirely new commerce experiences as intelligent agents shop across the open web.

Source: ARK Investment Management LLC, 2025. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Just as the rise of Google’s Search Engine Optimization (SEO) transformed digital publishing, AI agents should give rise to Agent-Oriented Optimization (AOO). As websites and APIs increasingly fail to meet the demands of retailers and service providers, MCP-compatible data that AI agents can discover, interpret, and prioritize will become the new norm. With a prompt like “buy the best running shoes under $100,” an AI agent will search inventories only accessible with MCP. Retailers that have not indexed properly will be out of luck.

Businesses that mastered SEO were the winners in the age of the internet. In the emerging agent-powered future, those that incorporate MCP will leapfrog slow adopters as intelligent agents make decisions on behalf of the consumer.

Are Marketplace Moats Defensible?

Historically, e-commerce marketplaces built economic moats based on brand equity and network effects. The leading platforms gained consumer loyalty, setting off a flywheel: the more users and sellers they attracted, the more difficult they were to displace.

Today, technology is altering that calculus, as AI purchasing agents change the way consumers interact with marketplaces. As they abstract users from the purchasing journey, AI agents could commoditize marketplaces. If AI agents were simply to seek the best product online, brand loyalty would diminish in importance, potentially reducing marketplaces to interchangeable, dumb pipes.

Instead of disintermediating marketplaces, however, AI agents will filter and rank them by performance metrics like price competitiveness, inventory availability, and fulfillment speed. As a result, AI agents will redefine what makes marketplaces valuable. The best among them will evolve into indispensable infrastructure enabling agents to execute transactions at scale with speed and precision.

So, how will marketplaces become defensible in this new era? Our research suggests that “stickiness” or “advertising budgets” will be much less relevant than operational excellence based on price, inventory, and speed. In the following sections, we explore the importance of each of these variables in creating marketplace moats that power the agentic economy.

Price

When AI agents can compare prices across the internet in seconds, offering the lowest price for identical products becomes table stakes.2 Consumer behavior already reflects this price sensitivity to some extent, with three in four shoppers browsing different marketplaces before purchasing and more than half of shoppers abandoning carts for a better price elsewhere, as shown below.

.png)

Source: ARK Investment Management LLC, 2025, ChannelX as of June 30, 2025.3 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

In the age of autonomous shopping agents, marketplaces will have to adopt dynamic pricing algorithms to stay competitive. The ability to re-price products rapidly to ensure that offers remain attractive in real time will be paramount. Today Amazon adjusts more than 2.5 million prices, tweaking ~15–20% of its product listings, per day. In contrast, traditional retailers like Walmart update ~50,000 prices per month, as shown below.

.png)

Source: ARK Investment Management LLC, 2025, based on data from Business Insider as of June 30, 2025.4 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Amazon’s pricing agility has become a strategic advantage in attracting price-sensitive consumers. Importantly, consumers tally up the full cost of a transaction, including shipping, service fees, and other hidden charges that often surface only at checkout, with 90% abandoning shopping carts with high shipping costs for standard items.5 Undercutting shipping costs can re-rank marketplaces as perfectly rational AI agents factor all costs into purchasing decisions.

Inventory

Marketplaces that serve as a “one-stop shops” have breadth and depth of inventory and can become product discovery hubs, raising the odds of satisfying user desires and needs—whether that’s specific features, specification, or brands. Unsurprisingly, nearly 48%6 of online shoppers begin their product searches on a major e-commerce marketplace like Amazon—not a search engine. Beyond product discovery, the purchase of multiple items from a single source also adds to consumer convenience and algorithmic efficiency. A savvy AI agent recognizes that bundling items from one marketplace reduces shipping costs, delivery friction, and complexity.

While building an inventory moat requires significant upfront investment—onboarding sellers, managing listings, and restocking for faster fulfillment—the payoff is recurring agent activity and sticky users, as shown below.

.png)

Source: ARK Investment Management LLC, 2025, based on data from ChannelX as of June 30, 2025.7 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Influenced by AI agents, the marketplace with the deepest, most reliable inventory earns the first-look. Intelligent agents will prioritize platforms that result in a high number of matches consistently. Just as humans gravitate toward marketplaces they trust for a one-stop shop, AI agents increasingly will favor those that maximize the probability of success, helping drive higher traffic and transactions and, ultimately, disproportionate market share in the agentic economy.

Speed Of Delivery

Delivery speed and reliability are critical variables that intelligent systems will evaluate for users. A marketplace that delivers products at comparable price points more quickly than others will have a significant competitive advantage. In other words, fast logistics is a moat built on warehouses, fulfillment centers, last-mile capabilities, and supply chain precision.

Amazon’s moat dwarfs others thanks to its vast network of fulfillment centers strategically positioned for “next-day-delivery” for most people in the US. Its logistics backbone has helped Amazon outpace other e-commerce players and out-compete brick-and-mortar incumbents, with convenience trumping in-store retail experiences.

.png)

Source: ARK Investment Management LLC, 2025, based on data from Commerce Canal and Red Stag Fulfillment as of June 30, 2025.8 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Importantly, if consistent, speed contributes importantly to a moat. In the absence of consistency, however, rapid delivery is meaningless. Marketplaces with consistently fast shipping also tend to have built trust through better package tracking capabilities and higher on-time delivery rates, as loyal shoppers value reliability.

The Opportunity

Infused with information at the consumer level, AI agents become increasingly sophisticated and can contribute to online purchasing decisions in a way that not only reduces friction in the buying process but also tailors purchases and experiences to the individual. As a result, they should be able to benefit categories that historically have lagged in digital adoption because of reliance on sensory evaluation, human expertise, or product complexity. Among those categories are luxury goods, high-end electronics, specialty health products, and home furnishings, verticals influenced significantly by expert advisers. AI agents can usurp the role of expert advisers, as they reduce uncertainty and foster confident, informed decisions online.

AI agents use knowledge to bridge the gap between the physical and the digital worlds through MCP streams by harnessing deep product metadata to learn consumer preferences and respond to real-time signals like availability and delivery windows. AI agents understand both products and people. Each interaction builds a user’s profile, adding to unprecedented personalization based on purchases, preferences, needs, and expectations in real time. As a result, the digital experience evolves from “browsing” to bespoke consultation, earning trust, boosting confidence, and expanding the products and services that can be sold online.9

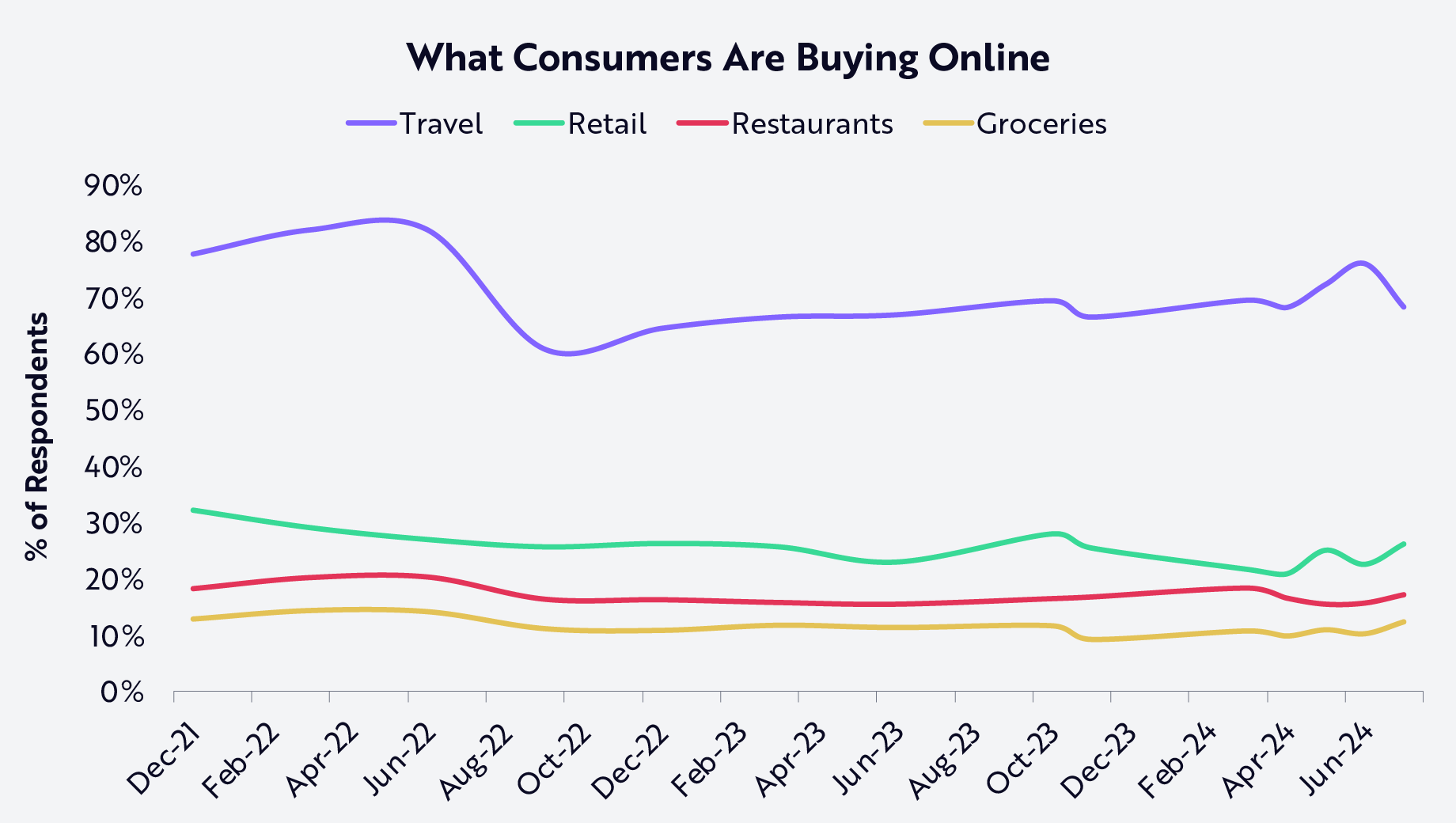

The economic ramifications of the shift to agentic AI shopping have been and, in our view, will continue to be significant. As of 2023, the average ticket for an online retail purchase was ~50% higher than that for an in-store purchase, as shown in the first chart below, underscoring the consumer’s willingness to transact in digital channels thanks to more intelligent and tailored experiences. While online already dominates travel, AI-driven tailwinds should remove more friction and continue to push digital shopping into non-apparel retail, restaurant orders, and even groceries, as shown in the second chart below.

.png)

Source: ARK Investment Management LLC, 2025, based on data from Pymnts as of June 30, 2025.10 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Source: ARK Investment Management LLC, 2025, based on data from Pymnts as of June 30, 2025.11 For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

According to our research, thanks to a broad-based re-platforming of commerce around intelligent API-accessible infrastructure, gross merchandise value (GMV) on global marketplaces could scale ~27% at an annual rate during the next five years, from $4 trillion in 2024 to $16 trillion by 2030, as shown below. AI agents are likely to boost transaction volume and reshape the nature of those transactions: what surfaces, how bundles form, and which platforms dominate. By structuring their data for discoverability and reducing the friction of integration, marketplaces with the strongest moats will deliver speed, breadth, and value at scale. AI Agents—and their users—will demand it.

.png)

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of July 21, 2025, which may be provided upon requestForecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Conclusion

The AI purchasing agent revolution will be a forcing function separating retailers with transactional relationships from those with algorithmic defensibility. Winners should be platforms so deeply integrated into production and delivery that bypassing them will become irrational economically. Our research suggests that as AI agents influence the shift of $9 trillion in spending power,12 economic value will flow to marketplaces that transform from passive inventory aggregators to active demand orchestrators.