#472: The Competition Between Tesla And Waymo Is Intensifying, & More

1. The Competition Between Tesla And Waymo Is Intensifying

During its second-quarter earnings call last week,1 Elon Musk announced plans to expand Tesla’s robotaxi operating region in Austin by ~10x and to reach ~50% of the US population by year-end, pending regulatory approvals. Discussions are underway in Arizona, Florida, Nevada, and the San Francisco Bay Area. Musk’s announcement followed Waymo’s decision to leapfrog Tesla’s expanded robotaxi footprint in Austin.2 Of note, Tesla currently uses a safety monitor, while Waymo is fully driverless.

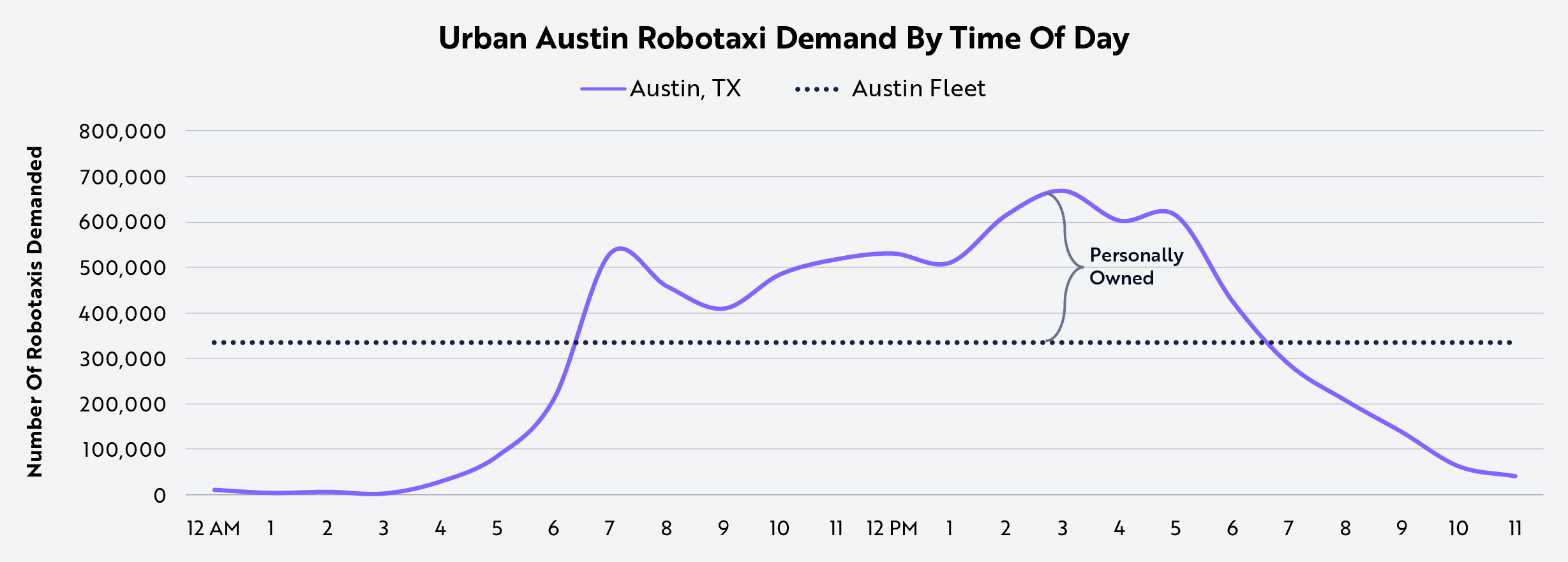

As competition intensifies, our research suggests that a robotaxi fleet of ~300,000 vehicles would be optimal in Austin to serve all urban vehicle miles traveled (VMT),3 if leveraging third-party vehicles to meet peak demand, as shown below. This model favors Tesla, given its ability to scale directly, while Waymo relies on partners like Uber, Jaguar, Zeekr, and Hyundai. At the current global production rate of Models 3 and Y, Tesla could produce 300,000 vehicles in just two months. In contrast, Waymo’s planned expansion to ~3,500 vehicles through next year would meet only ~1% of Austin’s urban VMT.4

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of July 24, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of July 24, 2025, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Stay tuned for our next blog on how Tesla could address the largest urban VMT regions in the US and why it is likely to lead in the robotaxi race during the next year.

2. Does The FDA’s Recent Actions Against Sarepta And Replimune Suggest A New Impediment To Innovation?

Under the leadership of Dr. Marty Makary5 and Dr. Vinay Prasad,6 the U.S. Food and Drug Administration (FDA) is recalibrating the drug approval process. While encouraging faster clinical development and review timelines, the FDA’s agenda also is emphasizing scientific rigor and public trust.7 That balance played out last week.

In an unprecedented showdown, Sarepta refused when the FDA requested that it suspend shipments of Elevidys,8 its gene therapy for Duchenne muscular dystrophy. Three days later,9 Sarepta reversed course.10

The FDA was responding to the report of a third patient death after treatment with an investigational product built on Sarepta’s AAVrh74 viral vector. Unlike the first two, which the company reported in press releases, the latest death surfaced in a third-party media report.11 Oddly, one day earlier, Sarepta did not disclose the death on an investor call when it announced a strategic pivot to RNA-targeted therapies.12 In response, the FDA rescinded the Platform Technology Designation that it granted Sarepta only weeks earlier for its AAVrh74 viral vector.13

While the safety concerns are serious, the FDA’s intervention now prohibits physicians and guardians from deciding if Elevidys is the right risk-benefit choice for non-ambulatory patients. Whether or not the right call, clearly the bar for both safety and evidentiary rigor is rising.

Not long after Sarepta paused Elevidys shipments, the FDA issued a Complete Response Letter to Replimune denying accelerated approval of its oncolytic virus therapy for advanced melanoma.14 In the rejection, the FDA said that the single-arm Phase 1/2 trial was not an adequate or well-controlled clinical investigation and that the heterogeneity of the patient population hindered interpretation of the trial. According to management, the FDA did not raise these issues in its mid- and late-cycle review, suggesting that prior regulatory alignment may not hold under the new rubric for gold-standard science at the FDA.

That said, we do not view these actions as inconsistent with the FDA’s recent messaging. Drs. Makary and Prasad have been vocal that the FDA will be an ally in accelerating cures and approving rare disease therapies at the first “sign of promise.”15 Recent decisions make clear, however, that deregulation will not come at the expense of rigor—the foundation upon which science and trust is built.

3. Digital Asset Treasury Companies Are A Proxy For Crypto Exposure

Recently, a new class of crypto-based public companies has emerged: Digital Asset Treasury companies (DATs). Often legacy businesses with underperforming core models, these firms have rebranded with a singular goal—to accumulate a crypto asset, typically bitcoin (BTC) or ether (ETH), and maximize the ratio of tokens per share. Pioneering this model, MicroStrategy created the blueprint by issuing debt and equity on a regular basis and buying bitcoin, becoming a BTC proxy in the public markets.16 These companies tend to trade at a premium to their mark-to-net-asset-value (mNAV), a phenomenon caused not only by a shortage of opportunities to gain exposure to bitcoin or ether in traditional financial markets, but also by investor expectations for significant appreciation in digital assets and leverage in the capital structure.

While compelling in bull markets, this strategy comes with layered risks if it stretches for yield and leverages the capital structure. DATs rely heavily on their ability to maintain a premium to NAV to sustain operations and finance digital asset purchases accretively. When the DAT market saturates and bullish momentum slows, companies could be tempted to deploy their treasuries into higher risk yield-bearing activities to juice returns. While staking ETH or solana (SOL) is relatively low-risk, companies could turn to onchain options, which would introduce risks associated with smart contracts, liquidations, and rehypothecation.

That said, tested in crises throughout 2022, blue-chip DeFi (Decentralized Finance) protocols have had strong track records thanks to overcollateralization, automatic and effective liquidation mechanisms, and robust security and audit processes to mitigate smart contract risk. Indeed, they have outperformed their centralized counterparts consistently during moments of stress and, while not eliminating all risks, historically they have provided viable alternatives for alternative value accrual. Thus far, most DATs have not integrated into DeFi but, if NAV premiums were to shrink or turn into discounts, the incentive to take on additional risk would grow, particularly for marginal players. This is derived from the sense that access to deep capital markets will be an advantage solely for larger players. While many of these vehicles may gain traction through public investors seeking easy access to crypto exposure, few new entrants are likely to achieve the scale, capital structure flexibility, and shareholder trust required to execute this playbook effectively over the long term.

-

1

Motley Fool Transcribing. 2025. “Tesla (TSLA) Q2 2025 Earnings Call Transcript.” The Motley Fool.

-

2

Waymo. 2025. “North to South, we’re covering more ground in Austin…” X.

-

3

This assumes the base fleet serves ~50% of peak demand and additional supply comes from third-party fleets such as vehicle owners or partners.

-

4

1% penetration assumes Waymo deploys its whole fleet in Austin. Waymo. 2025. See “Scaling our fleet through U.S. manufacturing.”

-

5

U.S. Food and Drug Administration. 2025. “Martin A Makary M.D., M.P.H.”

-

6

U.S. Food and Drug Administration. 2025. “Vinay Prasad M.D., M.P.H.”

-

7

Makary, M. A. and V. Prasad. 2025. “Priorities for a New FDA.” JAMA.

-

8

U.S. Food and Drug Administration. 2025. “FDA Requests Sarepta Therapeutics Suspend Distribution of Elevidys and Places Clinical Trials on Hold for Multiple Gene Therapy Products Following 3 Deaths.”

-

9

Sarepta. 2025. “Sarepta Therapeutics Provides Statement on ELEVIDYS.”

-

10

Sarepta. 2025. “Sarepta Therapeutics Announces Voluntary Pause of ELEVIDYS Shipments in the U.S.”

-

11

Usdin, S. 2025. “Third death from a Sarepta gene therapy.” Biocentury.

-

12

Sarepta. 2025. “Sarepta Therapeutics Announces Strategic Restructuring and Pipeline Prioritization Plan to Maintain Long-term, Sustainable Growth and Provides Update on ELEVIDYS Label.”

-

13

Sarepta. 2025. “U.S. FDA Grants Platform Technology Designation to the Viral Vector Used in SRP-9003, Sarepta’s Investigational Gene Therapy for the Treatment of Limb Girdle Muscular Dystrophy Type 2E/R4.”

-

14

Replimune. 2025. “Replimune Receives Complete Response Letter from FDA for RP1 Biologics License Application for the Treatment of Advanced Melanoma.”

-

15

Taylor, N.P. 2025. “FDA’s Prasad Vows To Make Rare Disease Drugs Available at ‘First Sign of Promise.’” Biospace. U.S. Food and Drug Administration. 2025. “Cell and Gene Therapy Roundtable.”

-

16

Jiang,C. 2025. “A New Frontier For Crypto Exposure.” Pantera.